In the world of DeFi, yield comes with risk—and staking is no exception. While liquid staking unlocks flexibility and capital efficiency, it also introduces new attack surfaces: smart contract exploits, validator slashing and governance manipulation.

For DOT holders seeking passive income, these risks aren’t just theoretical. In April 2025 alone, DeFi hacks cost the industry over $92 million, exposing serious vulnerabilities in protocol design and asset custody.

That’s why Bifrost takes a fundamentally different approach. As the leading liquid staking protocol in the Polkadot ecosystem, Bifrost is built not just to optimize yield—but to protect it. From sovereign account structures to on-chain insurance treasury and decentralized validator selection, every layer of Bifrost’s design is engineered for resilience.

Let’s explore how Bifrost turns staking into a secure, sustainable strategy for DOT holders.

Proactive Monitoring and Incident Response

Smart contracts are the core infrastructure of blockchain applications, and their security has a direct impact on user assets. Even minor vulnerabilities can result in significant losses. Historically, DeFi has seen numerous attacks triggered by smart contract bugs, often causing financial damage.

Bifrost adopts a proactive defense strategy through real-time monitoring and permission control:

- All vTokens are stored in derived addresses controlled by Bifrost's sovereign account. This account is keyless and can only be managed through OpenGov or SLP protocol logic with strict root-level permission control.

- Comprehensive audits are conducted by trusted security firms like OAK, SlowMist and CertiK, complemented by internal cross-team audit mechanisms to ensure continuous code optimization and timely vulnerability patches.

- Real-Time Monitoring & Emergency Response: The system monitors minted and reserved token balances in real time. If the difference exceeds a preset threshold, an alarm is triggered and an emergency pause mechanism is activated to secure user funds immediately.

- Even under extreme circumstances—such as a full takeover of Bifrost’s parachain by a malicious actor—DOT unstaking requires a 28-day unbonding period, providing ample time to respond through governance actions.

Enhanced Validator Decentralization

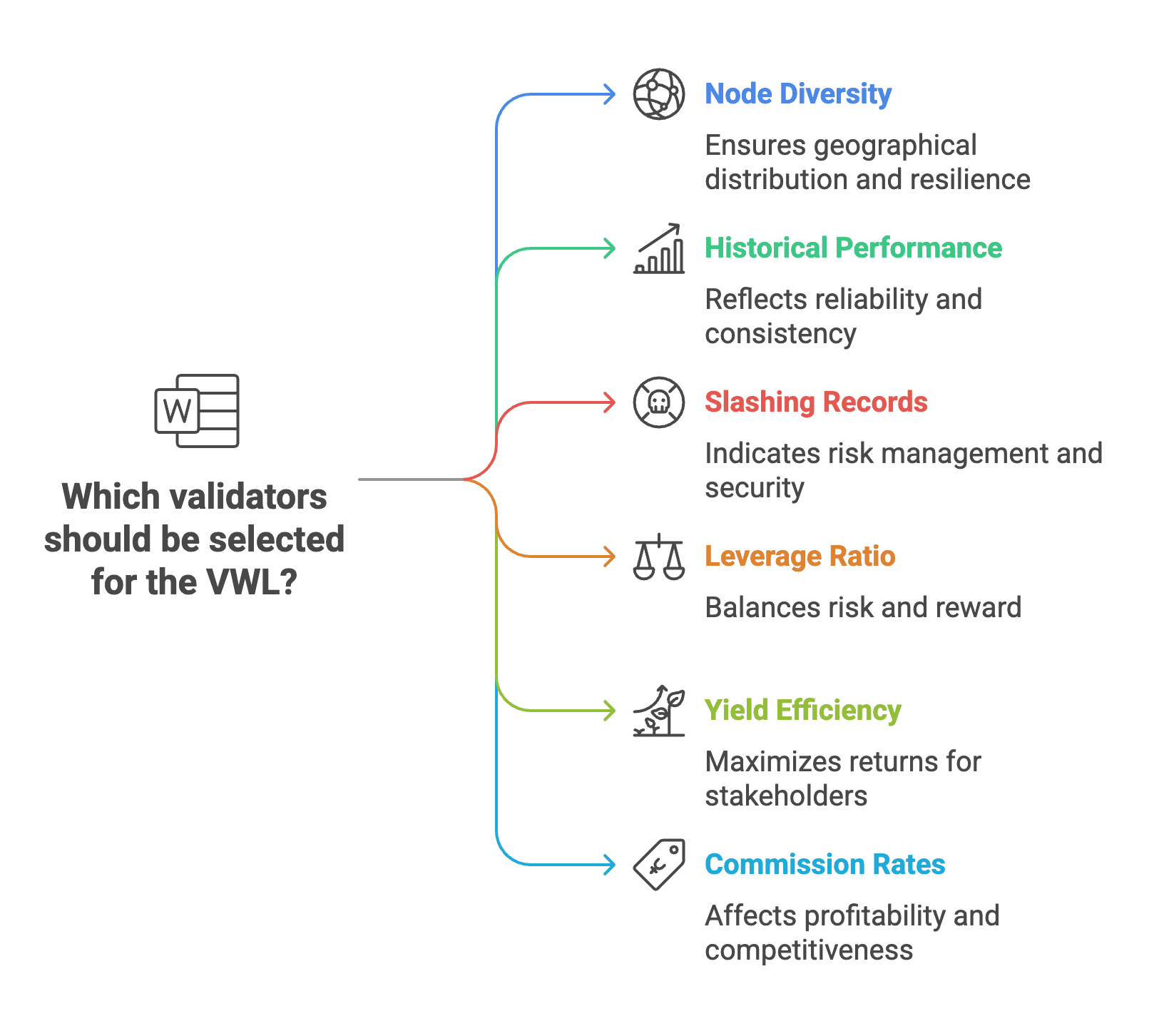

In PoS consensus, validator centralization can weaken network security and increase the risk of collusion or targeted attacks. Bifrost addresses this by implementing a dual-list mechanism: the Validator White List (VWL) and Validator Boost List (VBL).

- The VWL dynamically adjusts based on a transparent scoring system that evaluates reputation, security, performance, and geographic diversity.

- The VBL is curated through community governance and public voting.

Key metrics considered in VWL selection include node diversity by region, historical performance, slashing records, leverage ratio, yield efficiency, and commission rates. Validator rankings adjust dynamically to maintain a healthy, risk-controlled pool.

Slash Protection

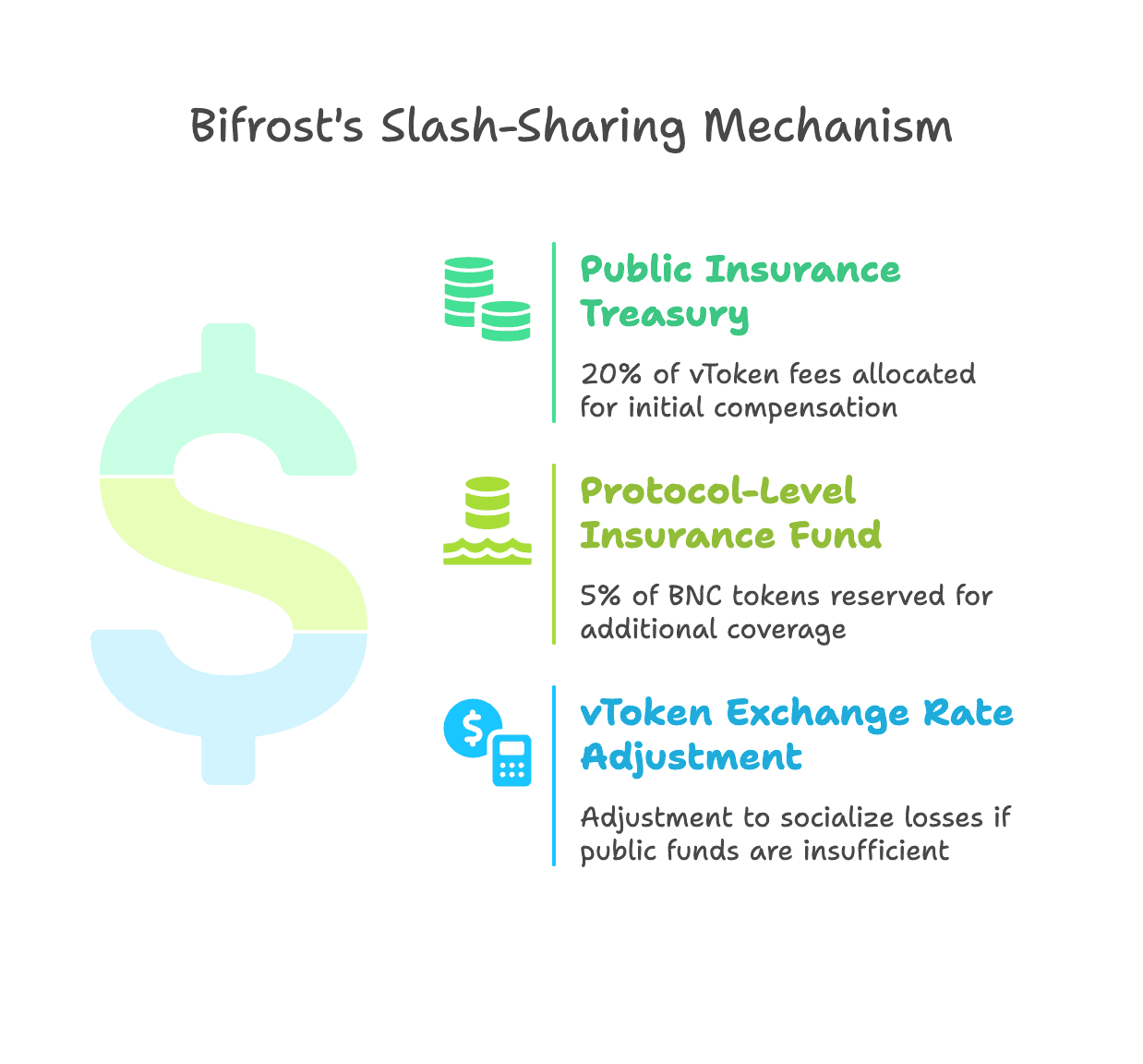

Slashing risk—when a validator’s misbehavior or technical failure causes staked assets to be penalized—is a critical concern in liquid staking. Bifrost has established a comprehensive slashing risk-sharing mechanism:

- 20% of all vToken commission fees are automatically allocated to a public insurance treasury.

- An additional 5% of BNC tokens are reserved as a protocol-level insurance fund.

- In the event of a slash, the public fund is used first for compensation. If insufficient, the protocol reserve is tapped.

- If both funds are inadequate, the vToken exchange rate is adjusted downward, effectively socializing the loss across all vToken holders.

This model minimizes individual loss exposure, and the longer the SLP protocol operates, the more secure it becomes.

To date, slash events are extremely rare and typically minor. In 2.5 years of SLP operations, only one slash incident occurred—caused by a Kusama upgrade—and it was later canceled through governance.

1:1 Reserve Backing of Underlying Assets

Bank-run risks in liquid staking often stem from theft of reserve assets or extreme market volatility. Bifrost mitigates this via its sovereign account custody model and protocol-level safeguards embedded in SLP logic.

vDOT reserves and exchange rate management are handled independently within the Bifrost network. vDOT is backed 1:1 with DOT, significantly reducing the impact of market fluctuations.

Even in the case of mass redemptions, only the swap price between vDOT and DOT is affected—there is no impact on the redemption price.

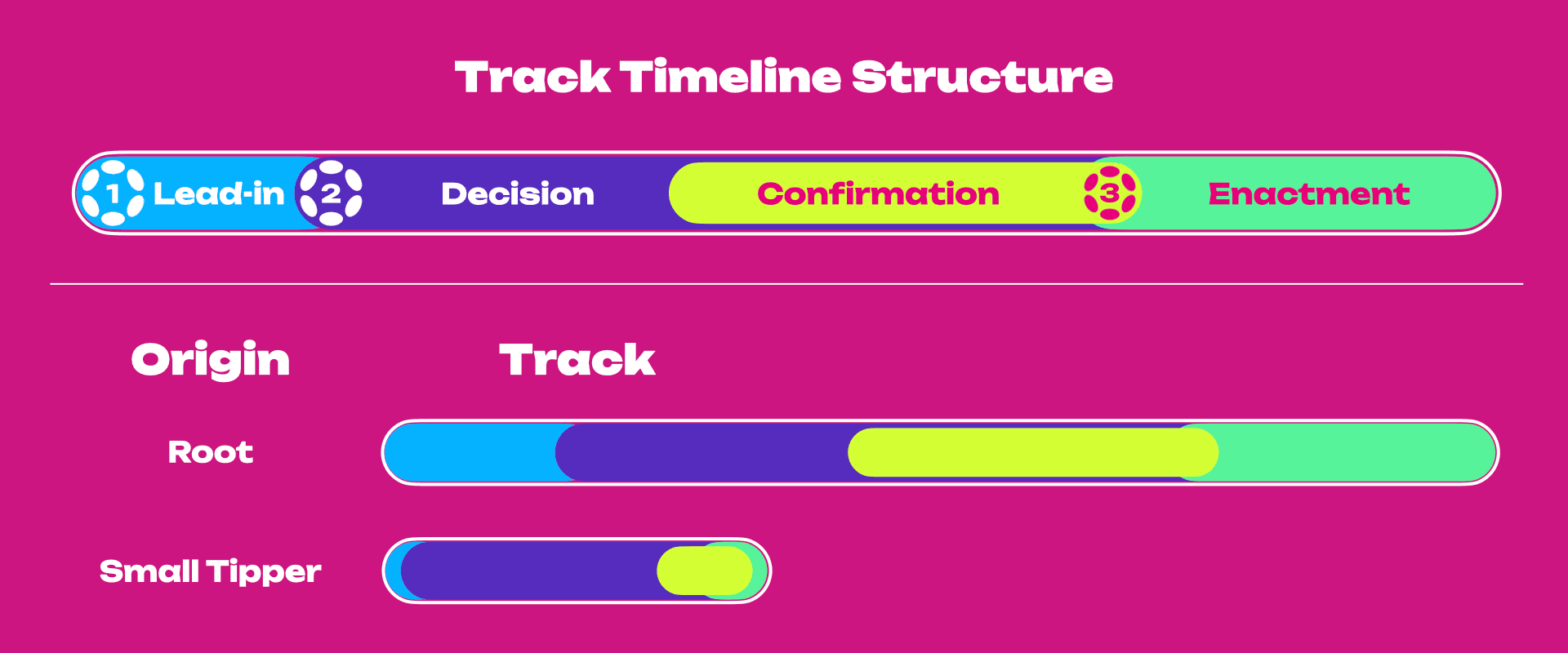

Robust Governance by OpenGov

Bifrost adopts Polkadot’s OpenGov as governance framework. Every decision undergoes a full discussion and voting period (typically 14 days), followed by at least a 2-day enactment delay. This ample buffer allows the protocol to detect and thwart governance-based attacks, ensuring that all decisions are fair, transparent, and community-approved—eliminating centralized control risks.

Conclusion

DeFi’s promise comes with undeniable risk—but risk can be managed. From validator slashing to smart contract exploits, every layer of infrastructure demands intentional design and constant vigilance. Bifrost recognizes that building a secure liquid staking protocol isn’t just about code—it’s about governance, transparency, and shared responsibility.

Liquid staking is a financial evolution and with sovereign account custody, real-time monitoring, community-driven validator selection, and multi-layered insurance mechanisms, Bifrost is setting a new standard for secure staking.